Six Goals, 12 Requirements

|

Payment application data security standard

The Payment Application Data Security Standard (PA-DSS) is for software developers and integrators of payment applications that store, process or transmit cardholder data as part of authorisation or settlement when these applications are sold, distributed or licensed to third parties.

PA-DSS requires vendors of third-party payment applications to ensure proper security controls are in place to safeguard cardholder data. Many of the controls within PA-DSS are designed to specifically address common vulnerabilities that were identified as main causes in credit card data loss.

Mastercard mandate effective July 1, 2012

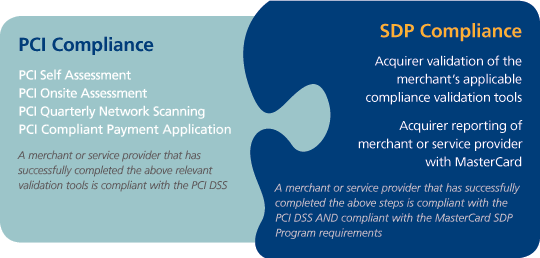

Effective July 1, 2012, Mastercard revised the Mastercard SDP Program Standards to require all merchants and service providers that use third party-provided payment applications to only use those applications that are compliant with the Payment Card Industry Payment Application Data Security Standard (PCI PA-DSS), as applicable. The applicability of the PCI PA-DSS to third party-provided payment applications is defined in the PCI PA-DSS Program Guide. In addition, Mastercard will establish a new PA-DSS compliance validation requirement for Level 1, Level 2 and Level 3 merchants as well as Level 1 and Level 2 service providers.

The Mastercard PA-DSS mandate will help continue to drive global adoption of and compliance with the PCI DSS for all stakeholders within the payment ecosystem.