In a technology-centric world, where mobile phones have become integral for participation in digital society, the payments landscape is facing continued pressure to evolve and present options that are undeniably secure and convenient.

This is especially crucial due to the contemporary consumer spending culture whereby many store their account information in locations such as online retailers, airlines, transportation networks and wireless carriers amongst other things.1 The abundance of this sensitive information online exposes a significant proportion of the population to security and fraud threats.

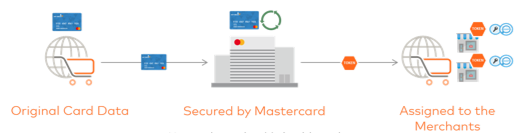

Therefore, Mastercard has created MDES for Merchants (referred to as M4M) to combat these risks by way of tokenisation. By replacing sensitive payment credentials with digital tokens, a superior e-commerce experience is created which provides increased security, approval rates and a frictionless consumer experience. Ultimately, M4M enables a safer payment ecosystem, inspiring trust from consumers and increasing transaction volume across the digital channel to return greater revenue for merchants.

Mastercard Digital Enablement Service for Merchants

What it is

The merchant payments landscape is undergoing a period of rapid, technology-driven change. To make payments a seamless part of the shopping experience, merchants increasingly encourage cardholders to store their payment credentials on file, powering faster checkouts, increased spending, and lower shopping cart abandonment.

MDES for Merchants allows merchants to convert the card information that consumers save on file into ‘tokens’ and to use this encrypted data to help secure transactions.

Next Steps

If you’re a merchant interested in increasing transaction volume and ensuring greater protection for your consumers, speak to your Payment Service Provider (PSP) or e-commerce platform to instigate discussions around MDES for Merchants. The technical integration documents here could be useful for these discussions.

1 - Mastercard Newsroom, Mastercard Continues to Define the Future of Digital Payments with Tokenisation Support for App E-Commerce and Recurring Payment Card of File Programs, Purchase NY – June 15, 2015

2 - Mastercard Global eCommerce Research, 2016

3 - Glenbrook research for Consumer Control

4 - Mastercard Advisors Consulting, “Embracing Digital Payments To Influence Cardholder Behavior And Bank Loyalty,” 2015